Are you in search of a reliable and affordable life insurance policy? Look no further than BB&T Life Insurance! With its competitive rates, customizable options, and excellent customer service, this company is quickly gaining recognition as one of the top providers in the industry. In this blog post, we’ll explore why BB&T Life Insurance should be on your radar and how it can provide peace of mind for you and your loved ones. Don’t wait any longer to secure your financial future – read on to learn more about what makes BB&T Life Insurance stand out from the rest!

Table of Contents

Introduction to BB&T Life Insurance

When it comes to life insurance, BB&T is a company that should be on your radar. They offer a variety of life insurance products that can meet the needs of most people.

BB&T has been in the business of financial services for over 150 years and is a trusted name in the industry. They offer both Term and Whole Life Insurance policies. In addition, they have an Universal Life Insurance policy that can provide coverage for your entire life.

The company is licensed to do business in all 50 states and the District of Columbia. They have an A+ rating from the Better Business Bureau and are a member of the Life Insurance Council of America.

If you are looking for a reliable life insurance company with a long history in the business, BB&T should be at the top of your list.

Types of Policies Offered by BB&T

There are three primary types of life insurance policies offered by BB&T: term life, whole life, and universal life.

Term life insurance is the most basic and straightforward type of policy. It provides coverage for a set period of time (usually 10-30 years), and if the insured dies during that time, the beneficiaries will receive a death benefit. There are no cash value or investment components with term life insurance.

Whole life insurance is a more comprehensive type of policy that includes both death benefits and cash value accumulation. The cash value component grows over time and can be accessed by the policyholder through loans or withdrawals. Whole life insurance typically has higher premiums than term life, but it also provides lifelong coverage.

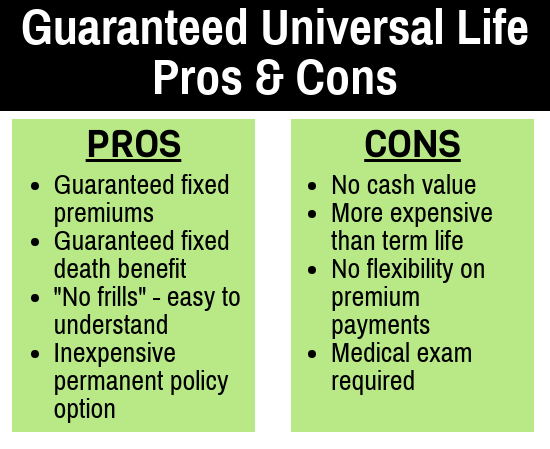

Universal life insurance is similar to whole life in that it offers both death benefits and cash value accumulation. However, the cash value component is more flexible, allowing the policyholder to make deposits and withdrawals as needed. Universal life also typically has lower premiums than whole life insurance.

Benefits of BB&T Life Insurance

There are many benefits to having BB&T life insurance. For one, it can help your loved ones financially if you die unexpectedly. A life insurance policy can also be used as part of your overall financial planning and can help pay for final expenses, like funeral costs.

Additionally, life insurance can give you peace of mind knowing that you and your family are taken care of financially if something happens to you. It’s important to have a life insurance policy that meets your needs and fits your budget.

BB&T offers a variety of life insurance products, including term life, whole life, and universal life. We can work with you to find the right coverage for your situation. Contact us today to learn more about BB&T life insurance and how it can benefit you and your family.

Financial Strength Ratings

When it comes to life insurance, one of the most important things to consider is the financial strength rating of the company. This is a measure of the company’s ability to pay out claims, and it’s something you should always look at before buying a policy.

BB&T Life Insurance has an excellent financial strength rating from all of the major rating agencies. That means you can be confident that they will be able to pay out on any claims you may have. In addition, BB&T Life Insurance has a history of paying dividends to policyholders. That means that not only will your family be taken care of financially if something happens to you, but you may also get some money back over time.

How to Get a Quote

When you’re shopping for life insurance, it’s important to get quotes from a variety of different insurers. This will help you compare rates and find the policy that’s right for you.

Getting a quote from BB&T is easy. Just visit their website and fill out a short form. You’ll need to provide some basic information about yourself, including your age, gender, and smoking status. Once you’ve submitted the form, you’ll receive a quote within minutes.

If you’re looking for a life insurance policy that offers great value and protection, BB&T should be on your radar. Their quotes are competitive, and they offer a variety of policies to choose from. Plus, they have an excellent reputation in the industry. So why not get a quote from them today?

Coverage Options

There are two main types of life insurance: term life insurance and whole life insurance. Term life insurance covers you for a set period of time, usually 10-30 years. Whole life insurance covers you for your entire life.

BB&T offers both term and whole life insurance policies. Their term life policy is called BB&T Simplified Issue Term Life Insurance. This policy has no medical exam and can be issued in as little as 10 minutes. Coverage amounts range from $5,000 to $500,000. The policy can be renewed up to age 80 and premiums will never increase.

BB&T’s whole life policy is called BB&T Heritage Whole Life Insurance. This policy does require a medical exam, but it has many features that make it worth considering. Coverage amounts range from $50,000 to $10 million. The policy builds cash value over time that can be accessed through loans or withdrawals. And like the term life policy, premiums will never increase and the policy can be renewed for life.

So which BB&T life insurance policy is right for you? That depends on your needs and budget. If you’re looking for immediate coverage with no medical exam, the Simplified Issue Term Life Insurance may be a good option. But if you’re looking for lifelong protection with cash value accumulation, the Heritage Whole Life Insurance may be a better choice. Either way, BB&T has you covered!

Claims Process

BB&T’s life insurance policies are some of the most affordable and comprehensive on the market, and their claims process is quick and easy. Here’s what you need to know about filing a claim with BB&T:

To start the claims process, you will need to gather some basic information about the policyholder, including their full name, date of birth, and Social Security number. You will also need to provide a copy of the death certificate. Once you have this information, you can contact BB&T’s claims department by phone or online.

The claims process is typically very quick and easy with BB&T. Their representatives are friendly and helpful, and they will work with you to get all the necessary paperwork in order. They will also help you understand any benefits you may be entitled to under the policy. In most cases, payments are made within 30 days of receiving all the required documentation.

Pros and Cons of BB&T Life Insurance

When it comes to life insurance, BB&T is a company that should be on your radar. They offer a variety of life insurance products that can meet your needs, whether you’re looking for term life insurance or whole life insurance. But like any company, they have their pros and cons. Here’s a look at the pros and cons of BB&T life insurance:

PROS

-A variety of life insurance products to choose from

-Competitive rates

-Flexible payment options

-Strong financial stability

-A+ rating from A.M. Best

CONS

-Not available in all states

-Limited online presence

Conclusion

BB&T Life Insurance offers coverage for a wide range of life events, from basic needs to specialized scenarios. With its competitive rates, flexible policies and customer service support, this insurer should be on everyone’s radar when it comes to choosing the best provider for their life insurance needs. Whether you need coverage for yourself or your family members, BB&T has something that can fit any budget and provide the peace of mind that comes with knowing you are protected in case of an unexpected event.